Andosi - Blog

Where we discuss The Art of Great System Design

Easily Generate PDF Documents in Dynamics 365 Sales

Sara Airgood

24 February 2023

Now it is easier than ever to generate a PDF document of a quote, invoice or other records in Dynamics 365 Sales using Export to PDF. In this article we will walk through how to Export to PDF and the options available through Export to PDF.

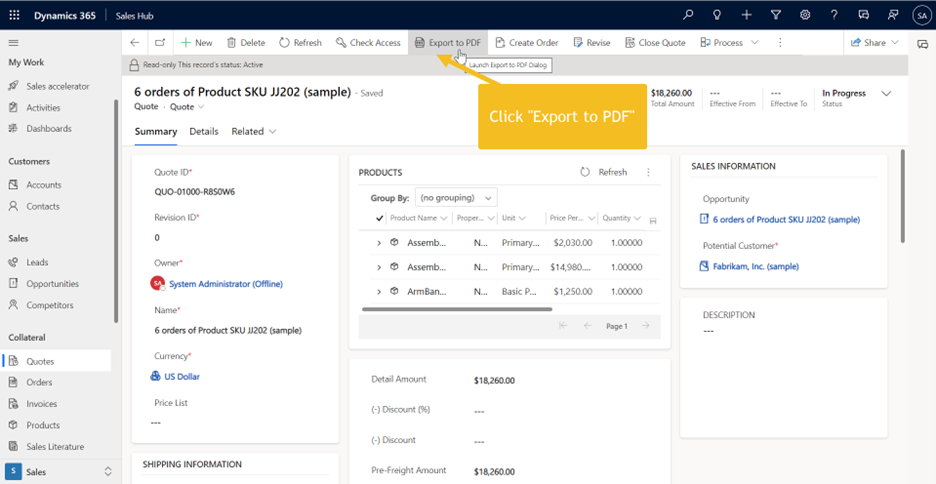

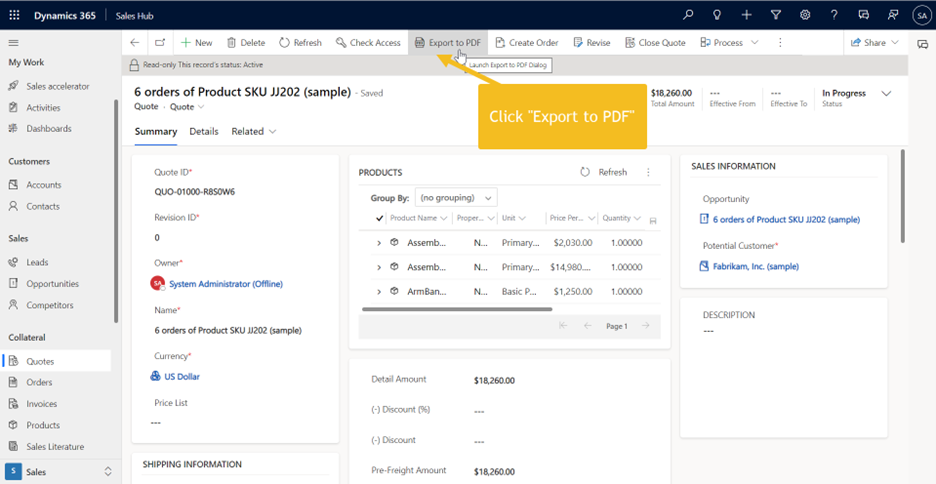

To try it out - open a quote and click the “Export to PDF” button.

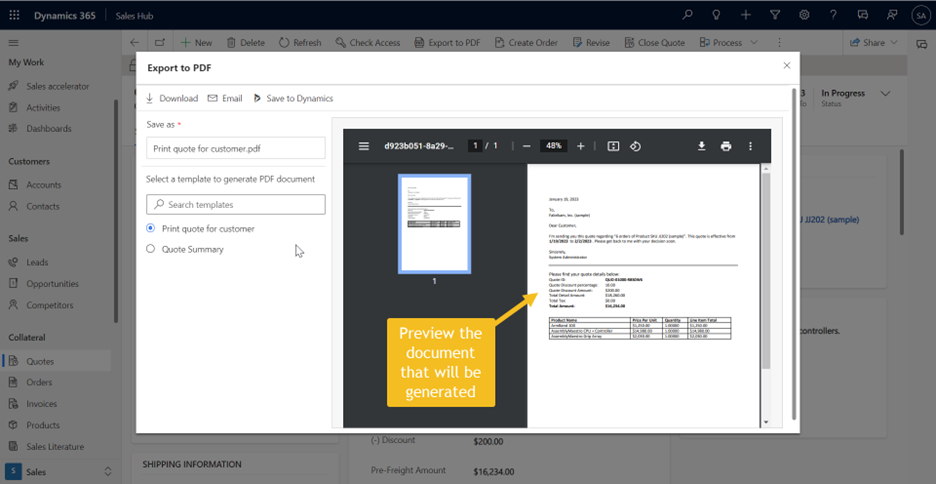

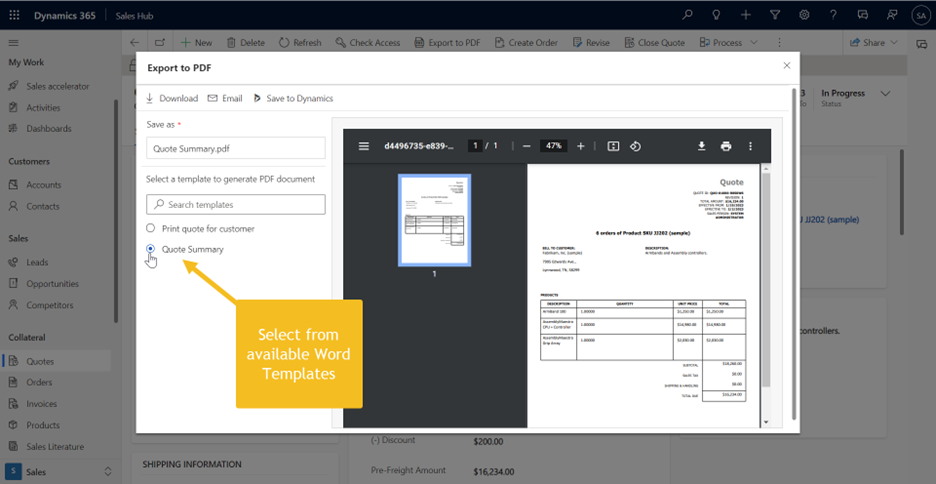

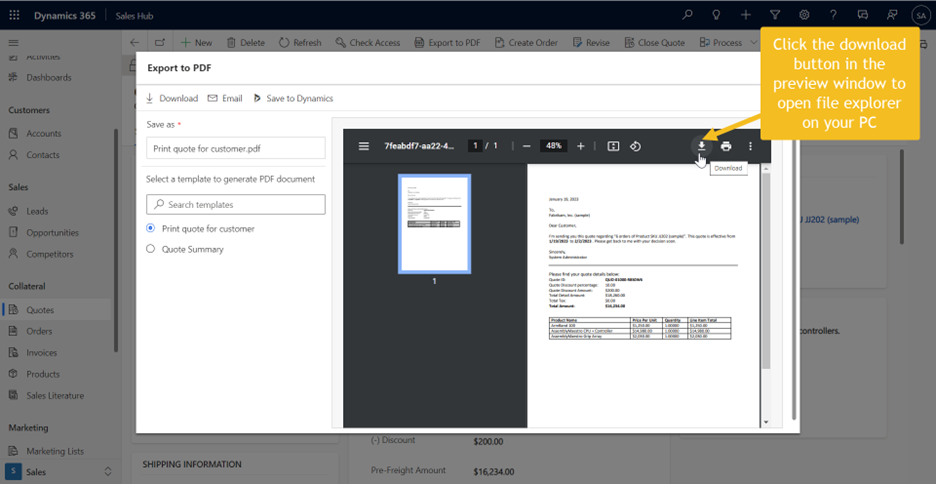

The Export to PDF window will open. Here you can select from the available document templates and preview the document.

There are five convenient actions available from the Export to PDF window:

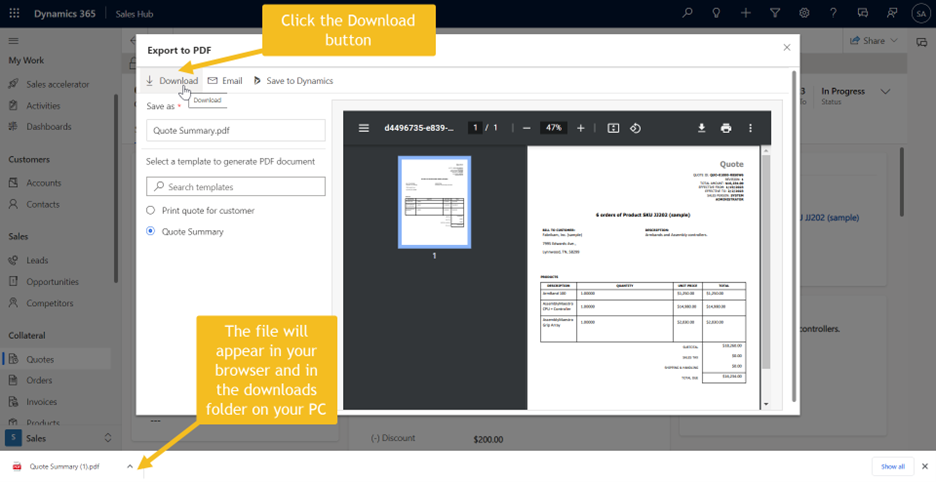

- Click the Download button to immediately download the document, it will appear in the browser window and in the downloads folder on your PC.

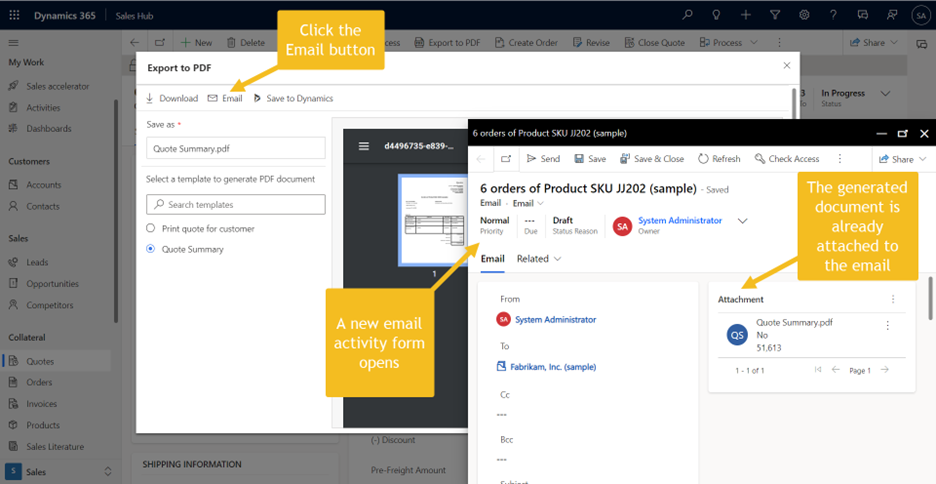

- Click the Email button to generate the document and open a new email window with the document already attached!

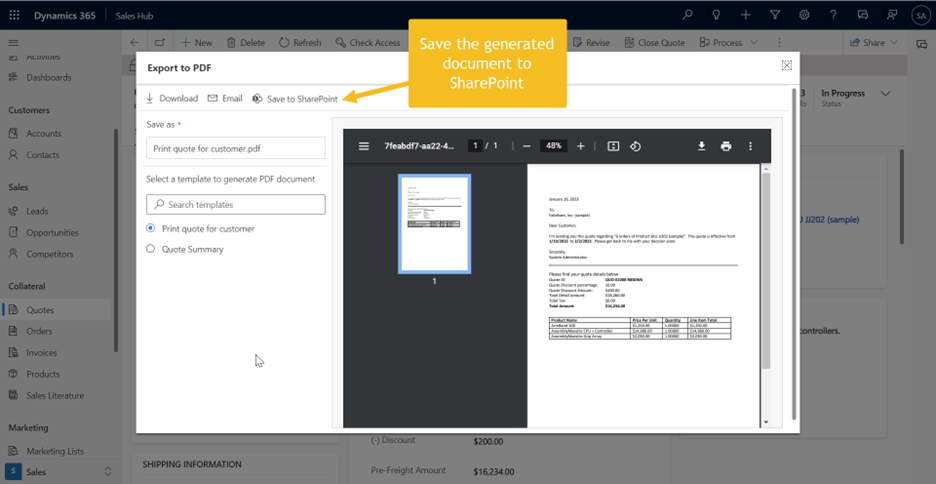

- To save the document to SharePoint, click the “Save to SharePoint” button. The document will be saved in SharePoint folder associated with the quote. Note that SharePoint integration must be configured first to save to SharePoint.

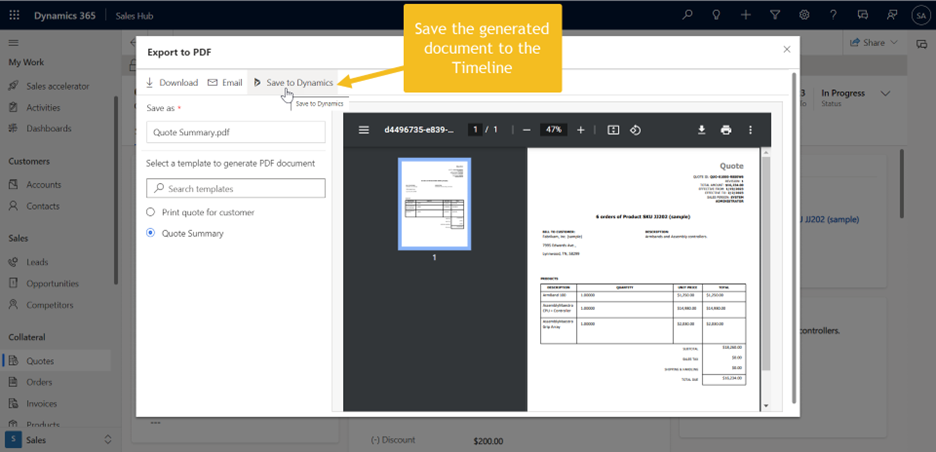

If SharePoint Integration is not configured, click the “Save to Dynamics” button. A note will be created with the PDF attached and saved on the record timeline.

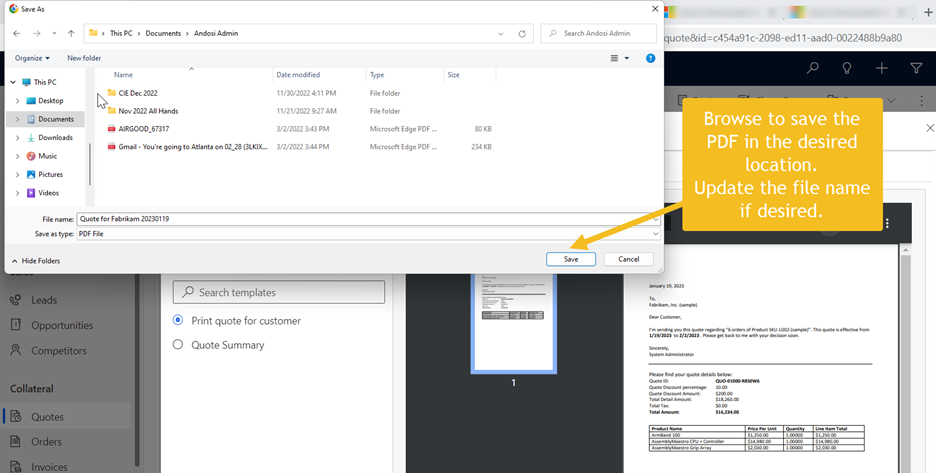

- To Open file explorer to specify where to save the generated document, click the Download button on the right side of the document preview window.

In file explorer, you may browse to the folder where you want to save the PDF and name it.

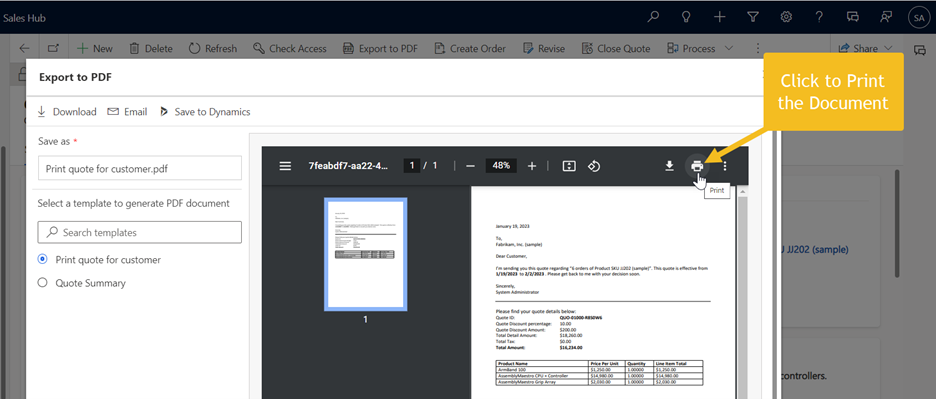

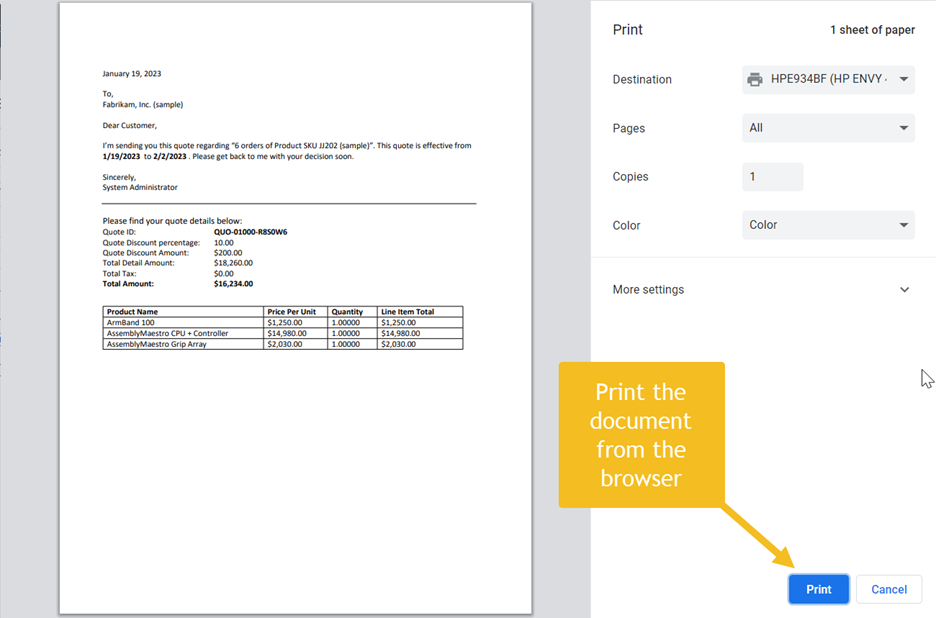

- To Print the generated document from the browser, click the Print button on the right side of the document preview window.

Print the document from the browser.

That’s it! We hope that this article helped you get to know the Export to PDF functionality.

More Blog Posts

Automating Deployments to Dynamics

Mark Johnston

In a previous post "Best Management Practices for Dynamics", we discussed the value of having multiple Dynamics 365 Environments in order to reduce the risk to the Production system and data when introducing new customizations. This post will intr...

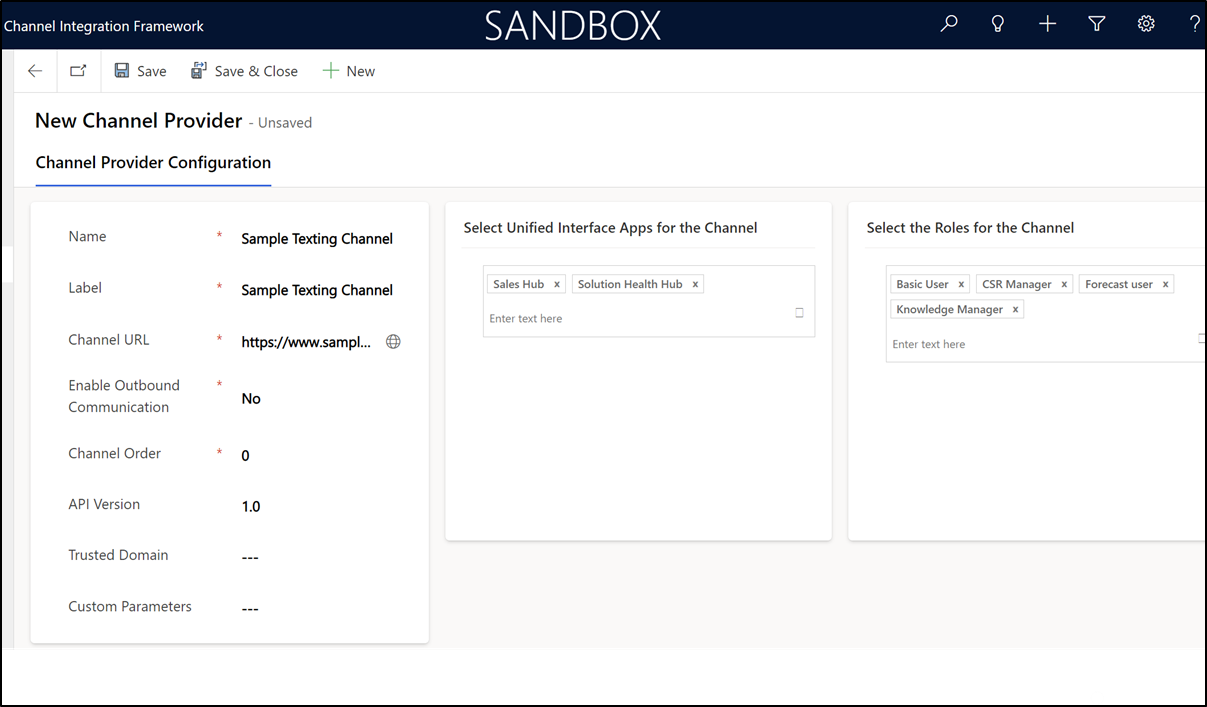

Differences and Limitations of Channel Integration Framework and Side Panes in Dynamics 365

Hamza Siddiqui

Model-driven apps offer a wide range of features and tools to help users streamline their workflows and access important information. Two such features are the channel integration framework and side panes, if you are looking to integrate a communi...